The Comprehensive Guide to Hedge Funds Database

Section 1: Introduction to Hedge Funds

In this section, we will provide an in-depth introduction to hedge funds, exploring the fundamental concepts and characteristics that define this unique investment vehicle. Understanding the basics of hedge funds is crucial for comprehending the importance and role of hedge funds databases.

1.1 What is a Hedge Fund?

A hedge fund is an alternative investment vehicle that pools capital from accredited individuals and institutional investors to pursue a wide range of investment strategies with the goal of generating high returns. Unlike traditional investment funds, hedge funds have the flexibility to employ a diverse set of investment techniques, including long and short positions, leverage, derivatives, and arbitrage opportunities. The primary objective of a hedge fund is to achieve positive returns regardless of the market conditions.

Hedge funds are typically managed by skilled investment professionals known as fund managers or hedge fund managers. These professionals employ their expertise and knowledge to identify and exploit investment opportunities that may not be readily available to traditional investment funds. Due to this flexibility and potential for high returns, hedge funds have gained significant popularity among sophisticated investors.

1.2 Hedge Fund Industry Overview

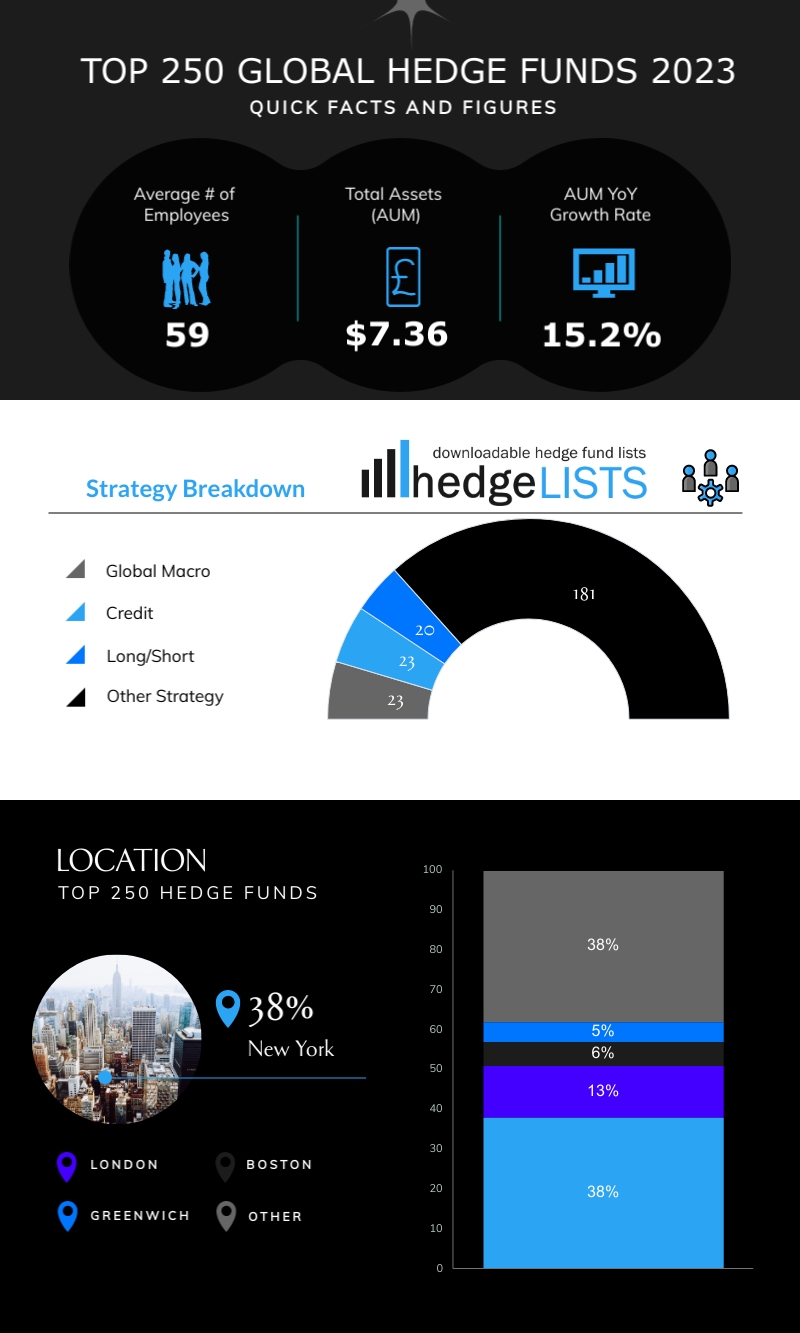

The hedge fund industry has experienced tremendous growth over the past few decades, evolving into a substantial segment of the global financial market. According to industry reports, the total assets under management (AUM) of hedge funds reached a staggering $10 trillion in 2023. In fact, the 250 largest hedge funds managed over $7.6 trillion in assets. This growth can be attributed to several factors, including increased investor appetite for alternative investment strategies and the potential for attractive risk-adjusted returns.

Hedge funds have become an integral part of the investment landscape, attracting a wide range of investors, including high-net-worth individuals, pension funds, endowments, and sovereign wealth funds. The industry’s growth has also led to the emergence of various hedge fund strategies, each with its unique investment approach and risk profile. Some common hedge fund strategies include long/short equity, global macro, event-driven, and quantitative trading.

1.3 Importance of Hedge Fund Databases

As the hedge fund industry continues to expand, the need for comprehensive and reliable hedge fund databases becomes paramount. A hedge funds database is a centralized repository of information that contains detailed data on hedge funds, their performance, investment strategies, holdings, and other relevant information. These databases play a crucial role in enabling investors, fund managers, and researchers to make informed investment decisions and gain insights into the hedge fund industry.

The importance of hedge funds databases can be summarized in the following key points:

- Performance Analysis: Hedge funds databases provide historical performance data, allowing investors to evaluate the track record of hedge funds and assess their risk-return characteristics. This information is vital for making informed investment decisions and comparing the performance of different funds.

- Risk Assessment and Management: Hedge funds databases enable investors to analyze the risk profile of various hedge funds. By examining factors such as volatility, drawdowns, and correlation with other asset classes, investors can better assess the risk associated with different investment strategies.

- Portfolio Construction and Optimization: Hedge funds databases provide valuable insights into the holdings and composition of hedge fund portfolios. This information is crucial for constructing well-diversified portfolios and optimizing asset allocation strategies.

- Due Diligence and Compliance: Hedge funds databases facilitate due diligence processes by providing comprehensive information on fund managers, investment strategies, and regulatory compliance. Investors can use these databases to verify the credentials and track record of fund managers before making investment decisions.

- Industry Research and Analysis: Hedge funds databases serve as a valuable resource for researchers and analysts studying the hedge fund industry. These databases enable them to conduct in-depth studies, identify trends, and gain insights into the dynamics of the market.

- Marketing and Business Development: Not all hedge fund databases focus on perfomance and risk-analysis. Some are designed specifically for marketing and outreach. Rather than fund performance and risk metrics, these marketing databases focus on employee contact info, such as phone and emails. HedgeLists is the leading provider of these hedge fund marketing databases and has been in business since 2009.

In the following sections, we will delve deeper into the key features and benefits of hedge funds databases, explore different types of databases, discuss how to choose the right database, and explore future trends and innovations in the hedge funds database space.

Section 2: Key Features and Benefits of Hedge Funds Database

In this section, we will explore the key features and benefits of hedge funds databases. These databases play a crucial role in providing investors, fund managers, and researchers with comprehensive and reliable information on hedge funds. By leveraging the data and analytical tools offered by these databases, market participants can make informed investment decisions and gain valuable insights into the hedge fund industry.

2.1 Comprehensive Data Collection

One of the primary features of hedge funds databases is their ability to collect and store vast amounts of data on hedge funds. These databases aggregate data from various sources, including regulatory filings, fund disclosures, and proprietary data providers. By consolidating this information into a single platform, hedge funds databases provide users with a comprehensive view of the hedge fund industry.

The data collected by hedge funds databases typically includes information on fund performance, investment strategies, asset allocation, holdings, and risk metrics. This wealth of data allows investors and fund managers to analyze and compare the performance and characteristics of different hedge funds. It also enables researchers to conduct in-depth studies and gain insights into the dynamics of the hedge fund industry. Hedge fund databases based on performance tend to be quite expensive due to the difficulty in collecting hundreds of fund metrics for thousands of funds. Typical costs range from $3500 to $10,000 or more. If you’re more focused on marketing to hedge funds and business development, there is a global hedge fund database priced at just $1665 ($965 with discount code SAVE700)

2.2 Historical Performance Analysis

Another key benefit of hedge funds databases is their ability to provide historical performance data on hedge funds. Investors and fund managers can access detailed performance metrics such as annual returns, volatility, Sharpe ratio, and maximum drawdowns. This historical data allows them to evaluate the track record of hedge funds and assess their risk-return characteristics.

By analyzing the performance of different hedge funds over time, investors can identify managers with consistent performance and track records. They can also assess the risk associated with different investment strategies and make informed decisions about portfolio allocation. Historical performance analysis is crucial for investors looking to build diversified portfolios and achieve their investment objectives.

2.3 Risk Assessment and Management

Hedge funds databases offer a range of risk assessment and management tools that enable users to evaluate the risk profile of various hedge funds. These databases provide comprehensive risk metrics such as standard deviation, beta, Value at Risk (VaR), and correlation coefficients. By analyzing these metrics, investors can assess the risk associated with different investment strategies and make informed decisions about portfolio construction.

Risk assessment tools provided by hedge funds databases help investors identify hedge funds that align with their risk tolerance and investment objectives. They also enable investors to evaluate the potential downside risk and volatility associated with different hedge funds. By understanding the risk characteristics of hedge funds, investors can make more informed decisions and manage their portfolios effectively.

2.4 Portfolio Construction and Optimization

Hedge funds databases offer powerful portfolio construction and optimization tools that enable users to build well-diversified portfolios. These tools allow investors to analyze the holdings and composition of hedge fund portfolios and assess their correlation with other asset classes. By incorporating hedge funds with low correlation to traditional asset classes, investors can achieve better portfolio diversification and potentially reduce overall portfolio risk.

Additionally, hedge funds databases provide analytical tools that help investors optimize asset allocation strategies. These tools allow users to simulate different portfolio scenarios, assess the impact of adding or removing hedge funds, and optimize risk-adjusted returns. By leveraging these portfolio construction and optimization tools, investors can build portfolios that align with their risk tolerance and investment objectives.

2.5 Due Diligence and Compliance

Hedge funds databases play a crucial role in facilitating due diligence processes and ensuring regulatory compliance. These databases provide comprehensive information on hedge fund managers, their backgrounds, and track records. Investors can use this information to verify the credentials and experience of fund managers before making investment decisions.

Furthermore, hedge funds databases enable investors to assess the compliance status of hedge funds. They provide information on regulatory filings, disclosures, and compliance with industry standards. This helps investors ensure that they are investing in hedge funds that adhere to best practices and comply with relevant regulations.

In summary, hedge funds databases offer a wide range of features and benefits that empower investors, fund managers, and researchers. These databases provide comprehensive data collection, historical performance analysis, risk assessment and management tools, portfolio construction and optimization capabilities, and facilitate due diligence and compliance processes. By leveraging the insights and analytics offered by hedge funds databases, market participants can make informed investment decisions and gain a competitive edge in the dynamic hedge fund industry.

2.6 Marketing and Business Development

There is another class of user for hedge fund lists and databases – those looking to market their products or services to hedge funds. These marketers may be selling tech solutions or trading tools. Or they may be offering products that meet the demanding needs of ultra high net worth investors (which hedge fund managers and there clients certainly are). Whether selling a trading tool, fund services, jet shares, real estate opportunities, or high end products, a hedge fund marketing database is a valuable tool. The best hedge fund marketing databases focus on verified contact information for top employees. The Global Hedge Fund Database has more than 10,000 emails for top employees at over 4500 hedge funds.

Section 3: Types of Hedge Funds Database

In this section, we will explore the different types of hedge funds databases available in the market. Each type of database serves specific purposes and caters to different user needs. Understanding the various types of hedge funds databases can help investors, fund managers, and researchers choose the most suitable database for their requirements.

3.1 Commercial Hedge Funds Databases

Commercial hedge funds databases are widely used in the industry and are typically offered by third-party data providers. These databases collect and curate data from a broad range of hedge funds, providing users with comprehensive coverage of the industry. Commercial databases offer a wide array of features and tools for data analysis, performance evaluation, risk assessment, and portfolio construction.

Here are some popular commercial hedge funds databases:

| Database Name | Key Features | |

|---|---|---|

| HedgeLists | Lowest priced, designed for marketers, rich with emails and contact info | |

|

Bloomberg Terminal | Extensive coverage, real-time data, robust analytics |

|

Eurekahedge | Global coverage, historical performance data, customizable reports |

|

Hedge Fund Research (HFR) | Extensive performance indices, risk analysis tools, strategy-specific data |

|

Morningstar Hedge Funds | Diverse investment strategy coverage, comprehensive fund profiles, research reports |

Commercial databases often require a subscription or licensing fees to access their services. They are suitable for professional investors, fund managers, and researchers who require comprehensive data and advanced analytical tools.

3.2 Proprietary Hedge Funds Databases

Proprietary hedge funds databases are developed and maintained by individual hedge fund firms for their internal use. These databases contain data specific to the hedge fund and may include detailed information on fund strategies, positions, and performance metrics. Proprietary databases offer fund managers the advantage of having direct access to their own data, allowing for customized reporting and analysis.

Proprietary databases are not publicly available and are limited to use within the firm. They are particularly useful for fund managers who require real-time access to their fund’s performance and portfolio data. These databases can also facilitate better communication and collaboration within the fund management team.

3.3 Academic and Research Hedge Funds Databases

Academic and research hedge funds databases are designed to provide researchers and academics with comprehensive data for studying and analyzing the hedge fund industry. These databases often contain anonymized data from a broad range of hedge funds, allowing researchers to conduct empirical studies and generate insights into various aspects of hedge fund performance, risk, and strategies.

Some notable academic and research hedge funds databases include:

- Center for International Securities and Derivatives Markets (CISDM) Hedge Fund Database

- Wharton Research Data Services (WRDS) Hedge Fund Database

- EDHEC-Risk Alternative Indexes and Databases

Academic and research databases contribute to the advancement of knowledge in the field of hedge funds and provide valuable insights for both practitioners and policymakers.

3.4 Government and Regulatory Hedge Funds Databases

Government and regulatory agencies often maintain their own hedge funds databases to monitor and regulate the activities of hedge funds within their jurisdiction. These databases typically contain information on hedge fund registration, regulatory filings, and compliance records. Government and regulatory databases play a critical role in ensuring transparency and accountability within the hedge fund industry.

Examples of government and regulatory hedge funds databases include:

- U.S. Securities and Exchange Commission (SEC) EDGAR Database

- Financial Conduct Authority (FCA) Register (UK)

- Autorité des marchés financiers (AMF) Register (France)

These databases are primarily used by regulatory authorities, industry regulators, and compliance professionals to ensure adherence to relevant laws and regulations.

In the next section, we will discuss the factors to consider when choosing the right hedge funds database, including data coverage, accuracy, user interface, cost, and customer support. Understanding these factors will help users make an informed decision and select a database that aligns with their specific requirements.

Section 4: How to Choose the Right Hedge Funds Database

Choosing the right hedge funds database is crucial for investors, fund managers, and researchers to effectively analyze hedge fund performance, assess risk, and make informed investment decisions. In this section, we will discuss the key factors to consider when selecting a hedge funds database, ensuring that it aligns with your specific requirements and objectives.

4.1 Data Coverage and Sources

One of the first factors to consider when choosing a hedge funds database is the extent of its data coverage. The database should provide comprehensive coverage of hedge funds across different regions, investment strategies, and asset classes. Ensure that the database captures data from a wide range of sources, including regulatory filings, fund disclosures, and proprietary data providers.

Consider the following questions when evaluating data coverage:

- Does the database include a diverse range of hedge funds, including both established and emerging managers?

- Does it cover different investment strategies such as long/short equity, global macro, event-driven, real estate, and fund of hedge funds?

- Does it provide data on various asset classes, including equities, fixed income, commodities, and derivatives?

- Does the database capture data from reputable and reliable sources?

A database with comprehensive data coverage ensures that you have access to a wide range of hedge funds, enabling you to conduct thorough analysis and make informed investment decisions.

4.2 Data Accuracy and Quality

Data accuracy and quality are critical factors to consider when selecting a hedge funds database. Ensure that the database has robust data collection and validation processes in place to ensure the accuracy and reliability of the information. Look for databases that have rigorous quality control measures, including data cleansing and error-checking procedures.

Consider the following questions regarding data accuracy and quality:

- How does the database ensure the accuracy and integrity of the data it collects?

- Does it have robust data validation processes to identify and rectify any discrepancies or errors?

- Does the database provide transparency about its data sources and methodologies?

Accurate and high-quality data is essential for making sound investment decisions and conducting meaningful analysis. Therefore, choose a hedge funds database that prioritizes data accuracy and quality.

4.3 User Interface and Analytics

The user interface and analytics capabilities of a hedge funds database significantly impact its usability and effectiveness. A user-friendly interface with intuitive navigation and search functions allows for efficient data retrieval and analysis. Look for databases that offer advanced analytical tools, visualization capabilities, and customizable reports.

Consider the following questions regarding user interface and analytics:

- Is the user interface of the database intuitive and easy to navigate?

- Does the database offer advanced analytics tools such as performance attribution, risk analysis, and portfolio optimization?

- Can you easily create customizable reports and export data for further analysis?

- Does the database provide interactive charts, graphs, and visualizations to enhance data interpretation?

A well-designed user interface and robust analytics capabilities enhance your ability to extract insights from the database and make informed investment decisions.

4.4 Cost and Pricing Models

The cost and pricing models of hedge funds databases vary significantly. Some databases require a subscription or licensing fee, while others may charge based on the level of access or the volume of data consumed. Consider your budget and requirements when evaluating the cost of a database.

Consider the following questions regarding cost and pricing:

- What is the pricing model of the database? Is it based on a subscription, licensing, or usage?

- Does the pricing align with the value and features offered by the database? Performance databases will be significantly more expensive the hedge fund marketing databases.

- Are there any additional costs, such as data integration or customization fees?

- Does the database offer different pricing tiers or packages to cater to different user needs?

- Does the database include updates or require monthly or annual fees. HedgeLists’ products are all one-time purchases (meaning no recurring fees, ever) and include 12 months of free updates.

Evaluate the cost of the database in relation to its features, data coverage, and the value it brings to your investment analysis process.

4.5 Customer Support and Integration

Lastly, consider the level of customer support and integration capabilities offered by the hedge funds database provider. Adequate customer support ensures that you can seek assistance when you encounter any issues or have specific data requirements. Integration capabilities allow you to seamlessly integrate the database with your existing systems and workflows.

Consider the following questions regarding customer support and integration:

- Does the database provider offer responsive customer support via phone, email, or live chat?

- Are there training resources or documentation available to help users navigate and maximize the database’s features?

- Does the database offer integration options with other tools or platforms you use, such as portfolio management systems?

- Can the database provider accommodate any specific customization or data integration requirements you may have?

A database provider that offers reliable customer support and integration capabilities can significantly enhance your user experience and ensure seamless integration with your existing processes.

By considering these factors, you can select a hedge funds database that aligns with your specific needs, budget, and objectives. A well-chosen database will provide you with the necessary data, analytics, and tools to make informed investment decisions and gain valuable insights into the hedge fund industry.

In the next section, we will explore the future trends and innovations in the hedge funds database space, including the impact of artificial intelligence, blockchain, big data, regulatory advances, and data security. Stay tuned for an exciting glimpse into the future of hedge funds databases!

Section 5: Future Trends and Innovations in Hedge Funds Database

In this section, we will explore the future trends and innovations that are shaping the landscape of hedge funds databases. As technology continues to advance and the needs of the industry evolve, hedge funds databases are undergoing significant transformations. From the adoption of artificial intelligence and blockchain to advancements in big data analytics and regulatory compliance, the future of hedge funds databases is poised for exciting developments.

5.1 Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the way hedge funds databases operate. These technologies have the potential to enhance data collection, analysis, and decision-making processes. AI-powered algorithms can automate data aggregation, cleaning, and validation, reducing manual efforts and improving data accuracy. ML algorithms can identify patterns and trends in hedge fund data, enabling more accurate predictions and optimized investment strategies.

With AI and ML capabilities, hedge funds databases can provide users with advanced analytics, anomaly detection, and personalized recommendations. These technologies can also facilitate natural language processing, allowing users to interact with the database using voice commands or text-based queries. AI and ML are expected to play a significant role in the future of hedge funds databases, enabling users to derive deeper insights and make more informed investment decisions.

5.2 Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) have the potential to revolutionize data security, transparency, and accessibility in the hedge fund industry. These technologies offer immutable and decentralized data storage, ensuring the integrity and reliability of hedge fund data. By leveraging blockchain and DLT, hedge funds databases can provide users with greater trust and confidence in the data they access.

Blockchain-based hedge funds databases can also facilitate secure and efficient sharing of data between different stakeholders, such as investors, fund managers, and regulators. Smart contracts built on blockchain can automate compliance processes, ensuring adherence to regulatory requirements. Additionally, blockchain and DLT can enable seamless and secure transactions, streamlining activities such as fundraising and settlement.

As the adoption of blockchain and DLT continues to increase, hedge funds databases are likely to incorporate these technologies to enhance data security, transparency, and operational efficiency.

5.3 Big Data and Predictive Analytics

The proliferation of big data and the advancements in predictive analytics are reshaping the capabilities of hedge funds databases. As more data becomes available from diverse sources, including social media sentiment, news feeds, and alternative data providers, hedge funds databases can leverage big data analytics to gain deeper insights into market trends, investor sentiment, and potential investment opportunities.

By harnessing the power of big data analytics, hedge funds databases can identify patterns and correlations that were previously difficult to detect. Predictive analytics models can leverage historical data to forecast market movements, assess risk, and optimize investment strategies. These capabilities enable users to make more accurate predictions and informed decisions based on a broader range of data sources.

Incorporating big data and predictive analytics into hedge funds databases empowers users to stay ahead of market trends and make data-driven investment decisions.

5.4 Regulatory and Compliance Advances

The regulatory landscape for hedge funds is evolving, and hedge funds databases are keeping pace with these changes. Regulatory and compliance advances are driving the development of databases that provide enhanced transparency and facilitate regulatory reporting requirements. Databases are incorporating features that enable users to monitor compliance with regulatory standards, track fund performance, and generate reports that adhere to regulatory guidelines.

Regulatory technology (RegTech) solutions are being integrated into hedge funds databases to automate compliance processes and ensure adherence to regulatory requirements. These solutions leverage technologies like AI, machine learning, and natural language processing to analyze regulatory texts, identify compliance gaps, and streamline reporting.

As regulatory requirements continue to evolve, hedge funds databases will play a crucial role in facilitating compliance and providing users with the necessary tools and data to meet regulatory obligations.

5.5 Cloud Computing and Data Security

Cloud computing is revolutionizing the way hedge funds databases operate, offering scalability, cost-effectiveness, and enhanced data security. By leveraging cloud infrastructure, hedge funds databases can store and process vast amounts of data more efficiently, enabling faster access and analysis. Cloud-based databases also offer greater flexibility in terms of data storage and retrieval, allowing users to scale their operations as needed.

Furthermore, cloud computing providers offer robust data security measures, including encryption, access controls, and regular backups. With the increasing focus on data privacy and protection, cloud-based hedge funds databases provide users with a secure environment to store and access sensitive financial information.

As cloud computing technology continues to mature, hedge funds databases are expected to transition to cloud-based platforms, offering users enhanced scalability, cost efficiencies, and robust data security measures.

In conclusion, the future of hedge funds databases is set to witness significant advancements driven by technologies such as artificial intelligence, blockchain, big data analytics, regulatory compliance, and cloud computing. These innovations will empower users with enhanced data analysis, predictive capabilities, data security, and compliance automation. By embracing these future trends, hedge funds databases will continue to play a pivotal role in supporting informed decision-making processes and driving the growth of the hedge fund industry.