Top 50 Credit Hedge Funds for 2023

2023 Top 50 Credit Hedge Funds Overview

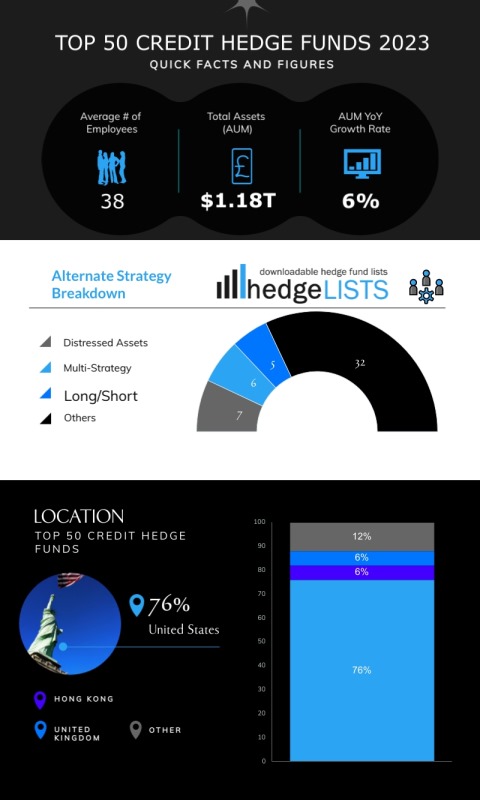

The 50 largest credit hedge funds worldwide manage a little over $1.18 trillion in assets.

Field Street Capital Management, with over $297 billion USD in assets is the largest credit hedge fund in the United States, as well as the world as a whole. Capula Investment Management and Cerberus Capital Management, with $118 billion and $80 billion in AUM respectively, rank second and third among the biggest fixed income / credit hedge funds.

About three fourths of the world’s largest credit hedge funds are based in the United States.

What are credit/fixed income hedge funds?

A credit hedge fund is a type of hedge fund that invests in debt securities, such as bonds, loans, and credit default swaps. Credit hedge funds use a variety of strategies to generate returns, including:

Relative value credit fund: These funds identify mispricings between different debt securities and take positions to profit from these mispricings.

Event-driven credit fund: These credit hedge funds invest in companies that are undergoing significant events, such as mergers and acquisitions, bankruptcy, or restructuring.

Distressed debt credit: These credit funds invest in debt securities of companies that are in financial distress.

Top 50 Credit Hedge Funds for 2023

List of the 50 biggest credit and fixed income hedge funds for 2023, ranked by assets under management (AUM)

Want more details on more than 850 credit hedge funds?

Key Stats on Top 50 Credit Hedge Funds in 2023

![]() 3 of the top 50 fixed income hedge funds for 2023 are based in Hong Kong

3 of the top 50 fixed income hedge funds for 2023 are based in Hong Kong

![]() 3 of the 50 largest credit funds for 2023 are based in Hong Kong

3 of the 50 largest credit funds for 2023 are based in Hong Kong

![]() The average AUM of the top 50 credit hedge funds for 2023 is $23.7 billion USD

The average AUM of the top 50 credit hedge funds for 2023 is $23.7 billion USD

![]() The median AUM of the top 50 hedge funds for 2023 is $11.4 billion USD / £5.3 billion GBP

The median AUM of the top 50 hedge funds for 2023 is $11.4 billion USD / £5.3 billion GBP

![]() The average number of employees at the top 50 credit hedge funds is 38

The average number of employees at the top 50 credit hedge funds is 38

Get the full list of all credit hedge funds in Excel format

The Credit Hedge Fund List has 40 categories of detailed information on all the funds above plus overy 500 additional hedge funds based in London and the UK. Everything from website to emails to senior staff, hiring status, number of clients and more is included. And it’s delivered in Excel format for easy use with any spreadsheet program or contact management system.

The Credit Hedge Fund List has 40 categories of detailed information on all the funds above plus overy 500 additional hedge funds based in London and the UK. Everything from website to emails to senior staff, hiring status, number of clients and more is included. And it’s delivered in Excel format for easy use with any spreadsheet program or contact management system.

View full details of the Credit / Fixed Income Hedge Fund List